One of the tax deductions that causes the most confusion (and worry) is the home office deduction. Are you eligible for it?

Who Can Claim It

To claim the home-office deduction, you must be self-employed. If you work for an employer and currently working from home, you’re not eligible. It doesn’t matter if you rent or own your own home.

First – what IS (and is not) a home office

Before we dive into how to calculate the deduction, we should discuss exactly what a “home office” is. The tax code defines it as a place used “regularly and exclusively” for business. That means a spare bedroom turned into an office qualifies, but the dining room table you sometimes sit at for work does not. You can use part of a room as an office if it’s a definable space (ie, “the corner area with the desk and shelves” counts, but “40% of the living room” does not). It can also be a separate structure on your property if you decide to turn a detached garage or shed into an office (and use it only for that purpose).

The tax code also requires that the home office be your “principal place of business.” That doesn’t mean you’re only allowed to work at your home – having more than one work location won’t disqualify you. It just means you either spend most of your time working at the home office or that the home office is the only place you do ‘administrative and management’ activities. For example, if you own a landscaping company and spend most of your time working at customer’s properties but keep your records and bills at your home office, you will qualify for the deduction. If that same business owner also maintained an office on Main Street where administrative duties were handled, they would NOT qualify for the home office deduction.

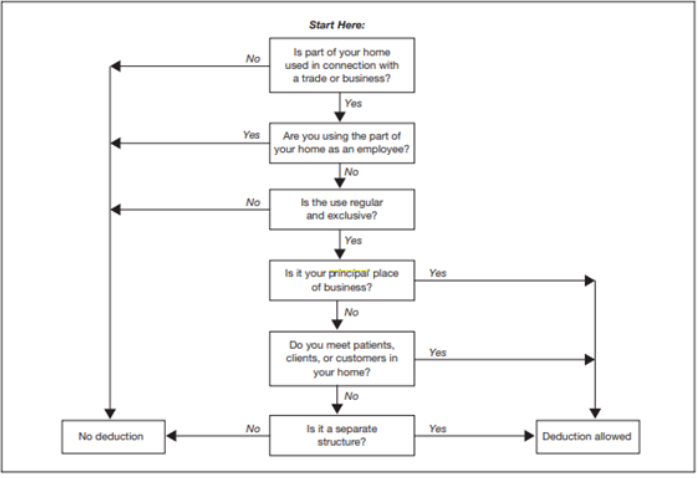

The IRS has helpfully created the following flowchart that recaps what we just discussed:

Source: IRS

Source: IRS

Now that you know if your home office qualifies, we can discuss how to calculate the deduction itself.

The “Simplified Method”

If the idea of allocating expenses or doing complex calculations makes you break out in a cold sweat, the IRS does offer a ‘simplified method’ for claiming the deduction. To use this method, simply multiply the size of your home office square footage (up to a maximum of 300 sf) by $5. That’s it. All your regular home expenses (like mortgage interest) can still be claimed as itemized deductions, and there’s no depreciation or anything like that to worry about.

Obviously, the main downside to this method is that you might be leaving money on the table. If your home office expenses are high, you might be entitled to more than $5 per square foot. In that case, use the regular method.

The “Regular Method”

To calculate the home office deduction using the ‘regular method’, you need to allocate home expenses you paid during the year to the portion of your home that was used as an office. (Similar to how you calculate your rental expenses if you’re renting out part of your home.)

Direct expenses are expenses that relate only to your home office. For instance, painting the spare bedroom you use as your office. These expenses are fully deductible.

Indirect expenses are expenses that affect your entire home. These would include mortgage interest or utilities expenses. These expenses are partially deductible. To figure out the percentage you can deduct, divide the home office area by the total area of your home. If you have a 500 sf home office in a 2000 sf home, 25% of your mortgage interest can be labeled a home office expense. Other common indirect expenses include real estate taxes, telephone and cable bills, and homeowner’s insurance.

The expenses you calculated above will go on Form 8829 (Expenses for Business Use of Your Home). The total amount on that form will feed into your Schedule C as one of your business expenses (if you’re a sole proprietor or single-member LLC; if you’re a member of a partnership it’s slightly more complicated, but you still might be able to deduct the expenses).

Limits

Unlike some other deductions, there aren’t any dollar limits on the deduction itself and the amount of the deduction won’t phase out as your income rises. However, the amount of the deduction can’t be more than your business income for the year. For example, if you make $10,000 in your business but have $15,000 of home office expenses, you can only use $10,000. The remainder can be rolled forward and used next year.

If you have any questions on the above or are just wondering if your own home office qualifies, send me a message and I’d be happy to discuss.